70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Quantitative trading, otherwise known as algorithmic or automated trading, has evolved significantly over the past decades. It has become increasingly popular in financial markets due to its ability to generate profits quickly and efficiently. Before the 1990s, quantitative strategies for trading were limited to the largest financial institutions that used computers to perform backtesting and simulation of trades.

Whole books and papers have been written about issues which I have only given a sentence or two towards. For that reason, before applying for quantitative fund trading jobs, it is necessary to carry out a significant amount of groundwork study. At the very least you will need an extensive background in statistics and econometrics, with a lot of experience in implementation, via a programming language such as MATLAB, Python or R. For more sophisticated strategies at the higher frequency end, your skill set is likely to include Linux kernel modification, C/C++, assembly programming and network latency optimisation. Quantitative trading is an extremely sophisticated area of quant finance.

Risk Management

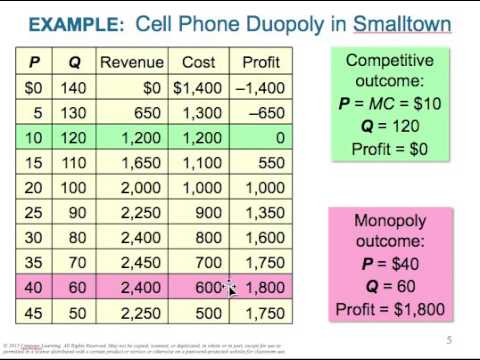

New regulatory environments, changing investor sentiment and macroeconomic phenomena can all lead to divergences in how the market behaves and thus the profitability of your strategy. When backtesting a system one must be able to quantify how well it is performing. The “industry standard” metrics for quantitative strategies are the maximum drawdown and the Sharpe Ratio.

In this article, we review the history of quantitative investing, compare it to qualitative analysis, and provide an example of a quant-based strategy in action. Alongside their educational requirements, quant traders must also have advanced software skills. C++ is typically used for high-frequency trading applications, and offline statistical analysis would be performed in MATLAB, SAS, S-PLUS, or a similar package.

In quantitative trading, traders can build software or programs that combine mathematical models and trading concepts. The programmed mathematical models are automated software that help traders identify historical data patterns to make rational trading decisions. The trading concept selected for a program is based on the trader’s preferences and research scope.

Can an Individual run a Quantitative Trading Strategy?

We will discuss the common types of bias including look-ahead bias, survivorship bias and optimisation bias (also known as “data-snooping” bias). Other areas of importance within backtesting include availability and cleanliness of historical data, factoring https://1investing.in/ in realistic transaction costs and deciding upon a robust backtesting platform. We’ll discuss transaction costs further in the Execution Systems section below. There are lots of different methods to spot an emerging trend using quantitative analysis.

One of the founding fathers of the study of quantitative theory applied to finance was Robert Merton. You can only imagine how difficult and time-consuming the process was before the use of computers. Other theories in finance also evolved from some of the first quantitative studies, including the basis of portfolio diversification based on modern portfolio theory. These strategies are not risk-free, hence they are combined with other High-frequency trading algorithms. Hence to overcome this time delay, firms have spent a huge amount of money on better, faster infrastructure and reduced the latency to its lowest.

Programming is usually the last piece of the puzzle after the initial strategy design phase. However, it is increasingly important as new strategies require technical skills at the onset. Behavioural bias recognition is a relatively new type of strategy that exploits the psychological quirks of retail investors. Learn more about algorithmic trading, or create an account to get started today. If it finds that the pattern has resulted in a move upwards 95% of the time in the past, your model will predict a 95% probability that similar patterns will occur in the future.

The Quantcademy

Still, the patient reader is rewarded with a wealth of trading insights and information, making this an indispensable reference work for aspiring quant traders. Quantitative trading can be profitable if you first test and validate your algorithm. Unfortunately, traders often don’t set up bots properly, or if they do, the market changes in ways they didn’t anticipate, and they end up losing money. This can make it seem like quant trading doesn’t work, but the reality is that the trader is likely using a poorly optimized bot. Cryptocurrencies have cyclical patterns; quantitative trading techniques can help cash in on those trends. Traders can customize quantitative trading algorithms depending on the trader’s preferences and evaluate different parameters related to a cryptocurrency.

- This manifests itself when traders put too much emphasis on recent events and not on the longer term.

- They will then develop a program for this trend that analyzes Apple’s market history.

- It’s a big alternative to qualitative trading—which is an investment technique based on financial experts’ insight and analysis.

- In each case, pure quant traders don’t care about the company’s sales prospects, management team, product quality, or any other aspect of its business.

A quantitative trading style is designed to reduce the cost of buying and selling many securities in various transactions by streamlining those trades. Cryptocurrency is a unique asset that incorporates various technologies allowing for decentralization and programmable functions. Crypto-based quantitative trading has three categories, which are alpha, primitives, and risk models. There are reasons why so many investors do not fully embrace the concept of letting a black box run their investments.

Supercharge your skills with Premium Templates

An aspiring quant trader needs to be exceptionally skilled and interested in all things mathematical. In addition to an advanced degree, a quant should also have experience and familiarity with data mining, research methods, statistical analysis, and automated trading systems. Just like in “The Wizard of Oz,” someone is behind the curtain driving the process. As with any model, it’s only as good as the human who develops the program. Due to the complex nature of the mathematical and statistical models, it’s common to see credentials like graduate degrees and doctorates in finance, economics, math, and engineering.

Mathematical strategies can be used by quant traders to overcome these limitations. The primary difference is that algorithmic trading is able to automate trading decisions and executions. While a human can be a quant, computers are much faster and more accurate than even the most dexterous trader. Investment advisers often diversify across multiple securities in different regions.

So you build a program that examines a large set of market data on the FTSE 100 and breaks down its price moves by every second of every day. Quantitative analysis uses research and measurement to strip complex patterns of behaviour into numerical values. It ignores qualitative analysis, which evaluates opportunities based on subjective factors such as management expertise or brand strength. Be it fear or greed, when trading, emotion serves only to stifle rational thinking, which usually leads to losses. Computers and mathematics do not possess emotions, so quantitative trading eliminates this problem.

What Are the Risks?

Quant traders use statistical methods to identify, but not necessarily execute, opportunities. While they overlap each other, these are two separate techniques that shouldn’t be confused. Discover everything you need to know, including what it is, how it works and what quant traders do. Quantitative trading does, however, carry some considerable risks and many quant strategies have been known to fail.

This makes the actual trading process very straightforward by investing in the highly-rated investments and selling the low-rated ones. Quant strategies are now accepted in the investment community and run by mutual funds, hedge funds, and institutional investors. Advances in computing technology further advanced the field, as complex algorithms could be calculated in the blink of an eye, thus creating automated trading strategies. In this article I’m going to introduce you to some of the basic concepts which accompany an end-to-end quantitative trading system. The first will be individuals trying to obtain a job at a fund as a quantitative trader. The second will be individuals who wish to try and set up their own “retail” algorithmic trading business.

Electronic trading salaries are much higher outside banking – eFinancialCareers

Electronic trading salaries are much higher outside banking.

Posted: Tue, 12 Sep 2023 13:32:47 GMT [source]

If you are interested in trying to create your own algorithmic trading strategies, my first suggestion would be to get good at programming. My preference is to build as much of the data grabber, strategy backtester and execution system by yourself as possible. If your own capital is on the line, wouldn’t you sleep better at night knowing that you have fully tested your system and are aware of its pitfalls and particular issues? Outsourcing this to a vendor, while potentially saving time in the short term, could be extremely expensive in the long-term.

In the long run, the Federal Reserve stepped in to help, and other banks and investment funds supported LTCM to prevent any further damage. This is one of the reasons quant funds can fail, as they are based on historical events that may not include future events. If there is swift.quicksecure a possibility of one company’s increase in market share, Quant will open a long position in that company and a short position for its competitors. Mean reversion analysis is applied over several stocks in diverse portfolios, for a small period of time to reduce exposure.

How to be a Successful Quantitative Trader?

An automated strategy usually uses an API to open and close positions as quickly as possible with no human input needed. A manual one may entail the trader calling up their broker to place trades. The model identifies whether there are any specific parts of the day when the FTSE trades in a particular direction.

On the other hand, non-institutional quant traders can use momentum trading, which can be incredibly profitable over a shorter period. For example, quant traders engaged in momentum trading crypto can also leverage the market’s notorious volatility for increased profits. They feed that data into algorithmic trading software, and then the program is backtested and optimized in a virtual setting. The system is run in real-time markets using real money if favorable results are achieved. While a strong quant team will be constantly adding new aspects to the models to predict future events, it’s impossible to predict the future every time. Quant funds can also become overwhelmed when the economy and markets are experiencing greater-than-average volatility.

This is also the point at which a quant will decide how frequently the system will trade. High-frequency systems open and close many positions each day, while low-frequency ones aim to identify longer-term opportunities. Quantitative traders take advantage of modern technology, mathematics, and the availability of comprehensive databases for making rational trading decisions. The execution system is the process through which a list of trades is generated by the strategy and executed by a broker. The key consideration when creating an execution system is the interface to the brokerage, reduced transaction costs, and divergence of performance of the live system from the backtested performance.